fidelity california tax free bond fund

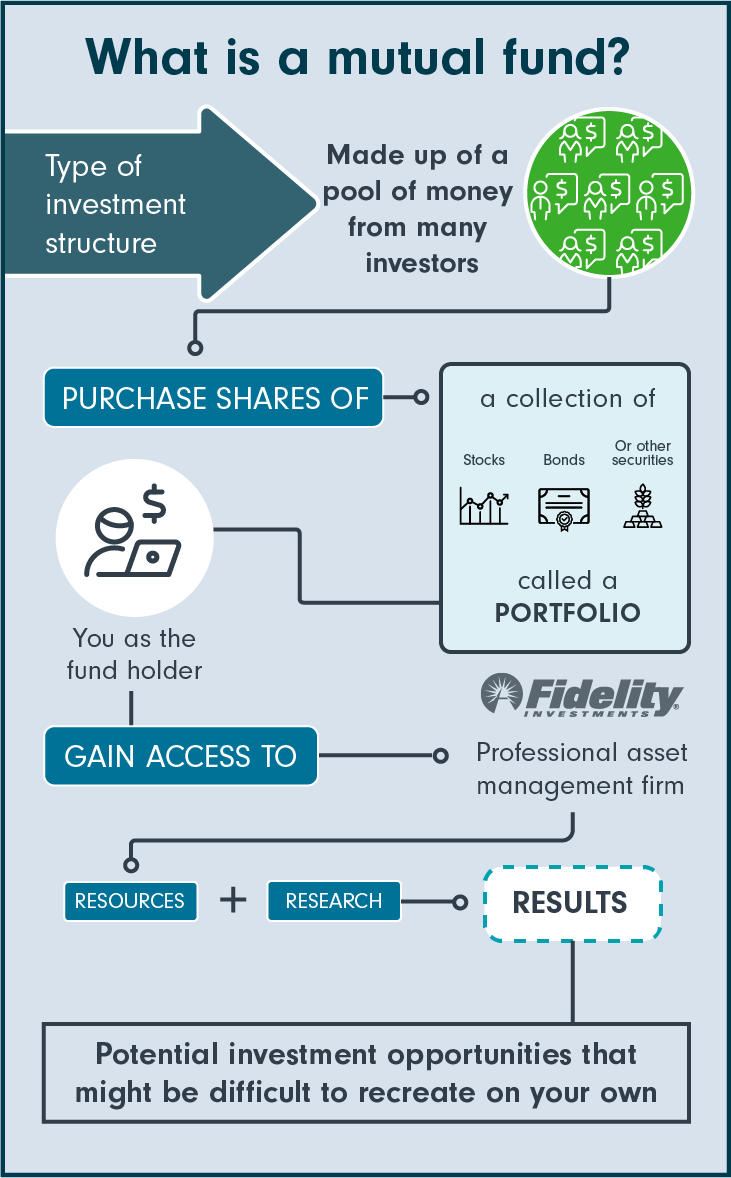

Fidelity Investments offers Financial Planning and Advice Retirement Plans Wealth Management Services Trading and Brokerage services and a wide range of investment products including Mutual Funds ETFs Fixed income Bonds and CDs and much more. Please click here for performance current to the most recent quarter-end and month-end.

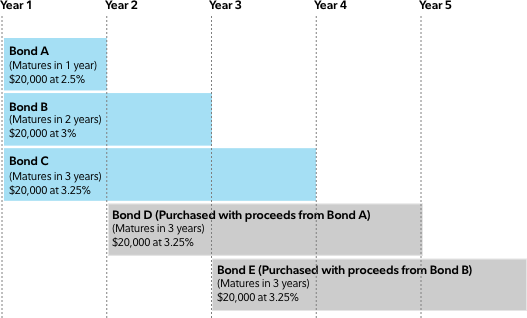

Bond Ladder Tool From Fidelity

PGIM High Yield Bond Fund Inc.

. Analyze the Fund Fidelity California Municipal Income Fund having Symbol FCTFX for type mutual-funds and perform research on other mutual funds. It also impacted nonqualified plans in several ways. Rowe Price Tax-Free High Yield Fund PRFHX T.

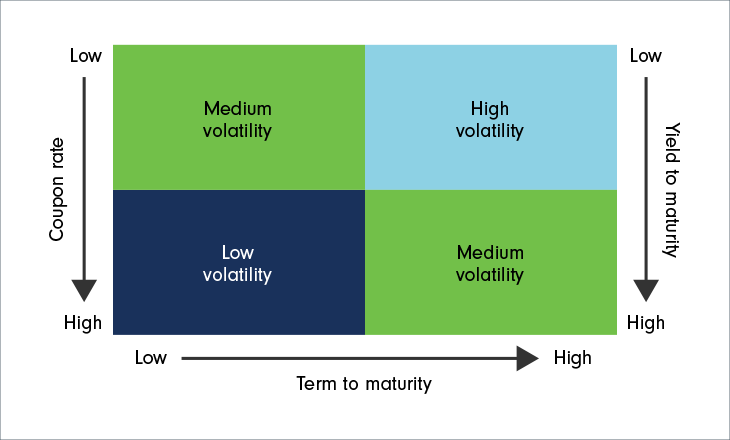

If the bond purchased is from a state other than the purchasers state of residence the home state may levy a tax. Rowe Price California Tax-Free Bond Fund PRXCX. A duration of 77 years for MANKX means that for every 1 increase or decrease in rates the value of the fund will fall or rise by roughly 77 respectively as bond prices move inversely to.

2017 tax law changes. Tax-smart ie tax-sensitive investing techniques including tax-loss harvesting are applied in managing certain taxable accounts on a limited basis at the discretion of the portfolio manager primarily with respect to determining when assets in a clients account should be bought or sold. American Century California High Yield Municipal Fund Investor Class BCHYX.

PGIM Global High Yield Fund Inc. See Fidelity Capital Income Fund FAGIX mutual fund ratings from all the top fund analysts in one place. And PGIM Short Duration High Yield Opportunities Fund declared today monthly distributions for September October and November 2022.

Nuveen California High Yield Municipal Bond Fund Class C2 since 3282006. The Tax Cut and Job Act of December 2017 the Act established new income tax rates corporate tax rates and modifications to many deductions. Tax-smart ie tax-sensitive investing techniques including tax-loss harvesting are applied in managing certain taxable accounts on a limited basis at the discretion of the portfolio manager primarily with respect to determining when assets in a clients account should be bought or sold.

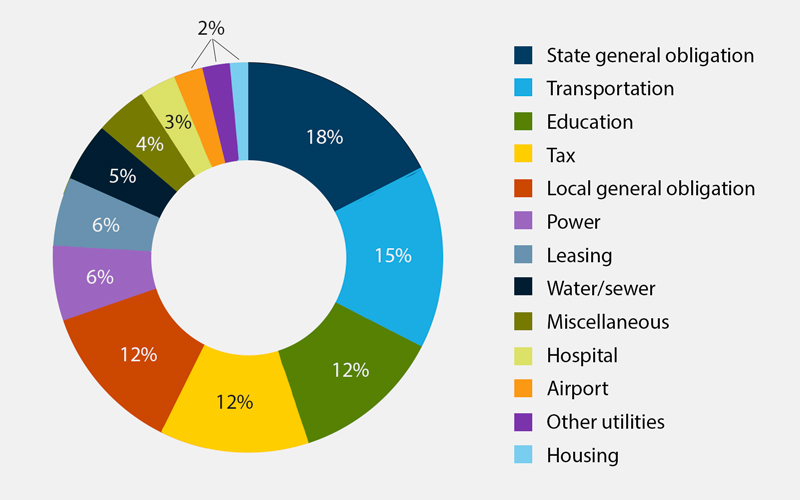

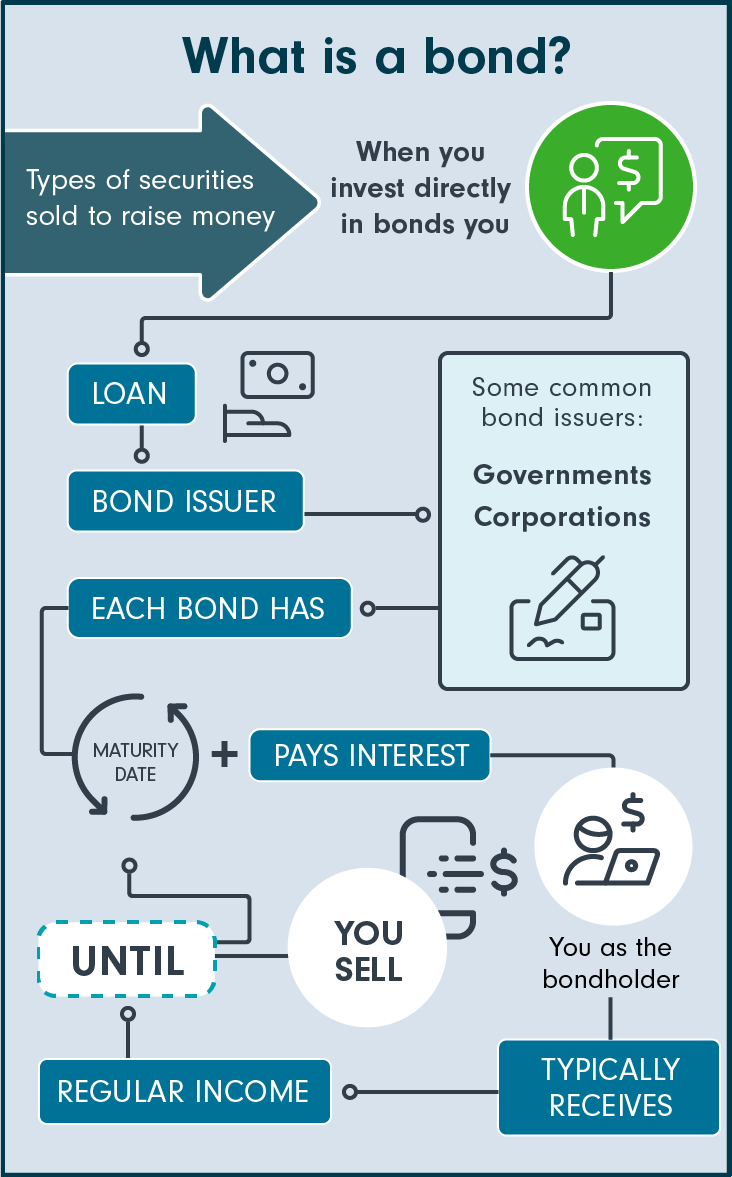

Municipal bonds are free from federal taxes and are often free from state taxes. Holdings will be updated according to the investment policy of the fund company. See Fidelity Capital Income Fund performance holdings fees risk and other data.

Month Ex-Date Record Date Payable Date September. For Fidelity funds holdings are updated on a calendar quarterly basis. Rowe Price Tax-Free High Yield Fund PRFHX.

We strongly recommend that executives review their NQDC opportunity with their tax and financial advisors. Morningstar rated the Lord Abbett Bond Debenture Fund class A share 3 3 and 5 stars among 282 247 and 141 Multisector Bond Funds for the overall rating and the 3 5 and 10 year periods ended 7312022 respectively.

New Fidelity Climate Leadership Funds To Harness Growing Investable Opportunities

7 Of The Best Fidelity Bond Funds To Buy

Making Sense Of Duration Sensitivity Bond Duration Explained

7 Best Bond Index Funds To Buy

Fidelity Money Market Funds How To Choose The Best One

Market Watch 2021 The Bond Market Fidelity

Investor Alert Fraudulent Documents

Best Municipal Bond Funds Best Mutual Funds Awards 2022 Investor S Business Daily

7 Of The Best Fidelity Bond Funds To Buy

Fidelity Climate Leadership Bond Fund

:max_bytes(150000):strip_icc()/Fidelity_Investments_Recirc-64c268bfd0824442ab46e820805d5474.jpg)

/Untitled-72f62d8eef3c4d358da00b4c45645f34.jpg)